If you wanted to create a billion dollar mobile game, 2012 - when global mobile games sales hit $9 billion - was the first year you could have achieved your goal.

- Supercell released Clash of Clans in August,

- King launched the mobile version of Candy Candy Saga in November, and

- GungHo Online kicked off the year with Puzzle & Dragons in February.

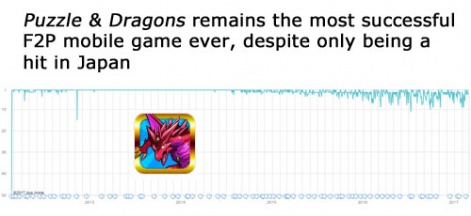

Originally developed by four staff, the Japanese match-3 RPG was an immediate success in the fast-growing Japanese smartphone market.

Puzzle & Dragons hit the #1 top grossing spot at launch, and pretty much stayed there for the next two years, becoming the first mobile game to generate $1 billion of sales, something it did during 2013.

Indeed, demonstrating the power of games-as-a-service, five years and 80 updates later, Puzzle & Dragons has only dropped out of the Japanese iPhone top grossing top 10 on a couple of occasions.

It remains GungHo’s top earner, with “Puzzle & Dragons related sales” (ranging from console games, to the annual conference, and other licensing) accounting for 84 percent of all revenues in 2016.

Global vs local

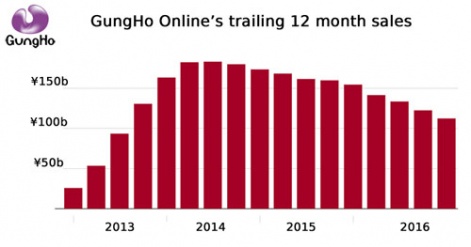

Yet, for all the success of Puzzle & Dragons, the game is now in decline.

For all its success, Puzzle & Dragons is now in decline.

Revenues peaked in 2014 and GungHo hasn’t had another significant hit on mobile or console.

Of course, this trajectory - early success, hopefully followed by a long, slow, managed decline - is natural for most entertainment products.

The fact Puzzle & Dragons has been a singular Japanese phenomenon is a contributing factor, however.

Ironically, the game’s success in appealing to its domestic market made it much less attractive internationally. Partly this is due to its look-and-feel, but mainly is down to its particular style of monetisation.

Hence, GungHo’s attempts to break Puzzle & Dragons into the western and Chinese markets have failed, and traction in countries such as Taiwan, Hong Kong and South Korea hasn’t converted into meaningful sales.

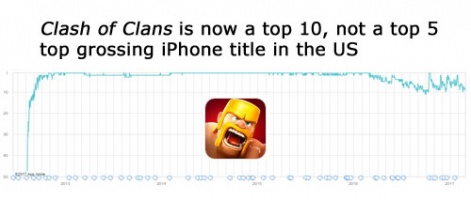

Clash of Clans' sales peaked in 2015.

The Japanese mobile gamer knows exactly what he wants and he’s happy to pay top yen for it too.

Clash and Crush

The contrast with the other two billionaire mobile games launched in 2012 is stark.

Taking a couple of months to become the #1 top grossing iPhone game in the US, Clash of Clans has experienced a much steadier growth curve.

It didn’t generate $1 billion in revenue until 2014 and sales didn’t peak until 2015. Mainly this was because its more accessible gameplay and monetisation meant sales were generated by the global expansion of its player base rather than optimising per player revenue.

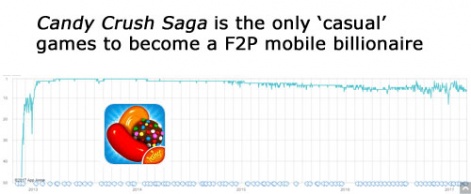

As a more ‘casual’ experience, Candy Crush Saga’s success was particularly driven by high download numbers, which, in turn, was fueled by connectivity features such as high score and gifting through Facebook social graph.

That meant Candy Crush experienced more explosive, viral growth than Clash of Clans, generating over $1 billion in 2013.

Only Supercell and MZ have launched more than one billionaire game.

Since then, it's seen a stronger decline in sales, although this has partly been offset as King has released sister games such as Candy Crush Soda Saga and Candy Crush Jelly Saga.

What’s next?

Having a billionaire game is a nice problem to have, of course, but does quickly become a problem, especially if your company is listed on a stock exchange.

GungHo is now having to deal with the managed decline of Puzzle & Dragons, as is its fellow outfit Mixi which is going through the same experience with another Japan-only billionaire F2P mobile game 2013’s Monster Strike (estimated revenue $4 billion).

King’s salvation from this problem came with 2015’s $5.9 billion acquisition by Activision Blizzard. Candy Crush Saga’s decline continues, of course, but King’s management doesn’t now also have to worry about the company’s declining share price.

Of the three, only Supercell managed to solve the problem.

In part, it was lucky to release Hay Day in 2012, which if not as successful as Clash of Clans, provided some additional revenue and head space. This was reinforced with 2014’s Boom Beach. Its success has, in part, been fueled by a massive marketing campaign made possible by Clash of Clans’ dollars.

But it was the company’s focus on innovative and accessible games that eventually lead to Clash Royale, which launched - and generated - $1 billion in 2016.

And in this context, it’s worth noting only Supercell and MZ (Game of War and Mobile Strike) have succeeded in launching more than one billionaire game.

That’s why they are the most valuable game companies to have been created in the F2P mobile game era.